New GST Rules for businesses with turnover of over INR 100 crore

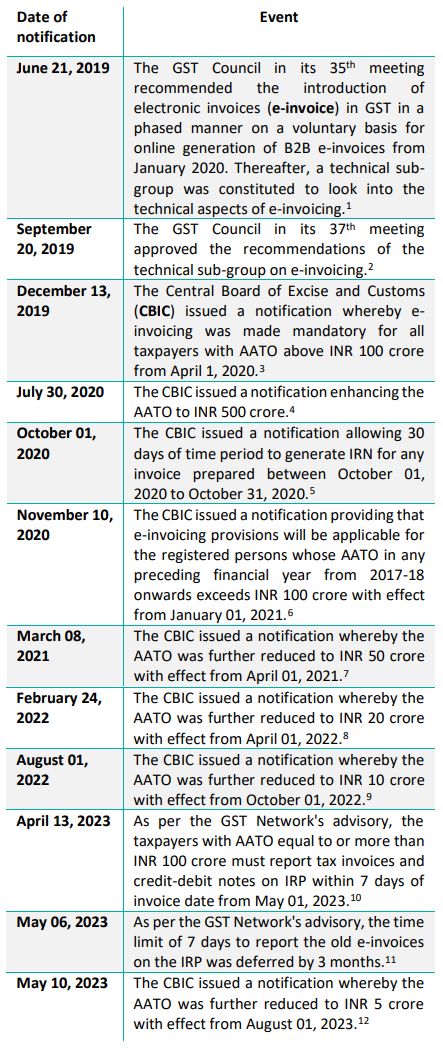

An advisory was recently issued on the Goods and Services Tax Portal regarding the time limit for reporting invoices on the Invoice Registration Portal (IRP) for taxpayers with Annual Aggregate Turnover (AATO) of greater than or equal to INR 100 crore. As per the advisory, taxpayers in this category will not be allowed to report invoices older than 7 days on the date of reporting. This restriction will apply to all types of documents for which Invoice Reference Number (IRN) is to be generated, including debit/credit notes. It is further clarified that there will be no such reporting restriction on taxpayers with AATO less than INR 100 crore. The change was to be implemented from May 01, 2023; however, the timeline has been deferred by 3 months, and will now be implemented from August 01, 2023 onwards.

Key aspects:

The implementation of timelines for reporting invoices on IRP will certainly assist in administering compliances and serves as a significant step towards digitalization. It will not only enhance efficiency but also reduce the scope for errors in invoice processing. It is crucial for businesses falling under this threshold to comply with the new rules to ensure a smooth transition and avoid any potential penalties.

The new measures will aid in increasing the GST collection as well as reduce the rampant practice of backdating invoices and decrease tax leakage. There are significant chances that the government may extend this rule to businesses having lower AATO in a phased manner in the future, and we believe that such extension would bring smaller businesses into the fold of digital invoicing, promoting uniformity and standardization across the GST ecosystem.

National Medical Device Policy

In April 2023, the Union Government approved the National Medical Device Policy, 2023 (Policy) aiming to make India a global leader in the manufacturing and innovation of medical devices by achieving 10-12% share in the expanding global market over the next 25 years. This Policy is expected to help the medical devices sector grow from the present USD 11 Billion to USD 50 Billion by the year 2030. The Policy is in line with the Government's 'Atmanirbhar Bharat' and 'Make in India' programs of encouraging domestic investments and production of medical devices. It is estimated that India's current market share in the medical devices category is 1.5% of the global space and 80-90% of medical devices are imported by India.

This has led to the Government of India introducing this export-driven manufacturing of affordable high-end offerings, that will in turn increase India's per capita spending on medical devices and make costly medical devices accessible and affordable. The Policy is aimed to be implemented with a patient-centric approach for facilitating an orderly growth of the medical device sector to meet the public health objectives of access, affordability, quality and innovation.

Prior to the Policy, the Drugs and Cosmetics Act, 1940 (DCA) was enacted to govern the quality and safety of medical devices in India as well as the production and distribution of it. Under the DCA, the Medical Devices Rules, 2017 (MDR) were brought into force by the Ministry of Health and Family Welfare, Government of India to govern and provide for a regulatory framework for medical devices for bringing all medical devices within the ambit of the MDR.

The Government of India has also introduced Production-Linked Incentive (PLI) schemes that aims to boost the manufacturing sector in India by offering financial incentives to companies that produce goods locally to reduce reliance on imports. Companies in certain sectors such as electronics, pharmaceuticals, and textiles are eligible to receive such financial incentives based on their incremental sales over a particular period in the form of a percentage of the additional sales which are paid over a period of several years. By providing incentives to companies that manufacture locally, the government hopes to attract more investment in the manufacturing sector and create employment opportunities for the local workforce. The Government of India under the PLI schemes has already approved 26 projects with an investment of approximately INR 1,206 Crore. The domestic manufacturing and production of high-end medical devices like linear accelerator, MRI scan, CT-scan, mammogram, C-arm, MRI coils, high-end X-ray tubes, etc., have already begun under the PLI schemes.

Key aspects:

- The Policy, with the aim of reducing dependency on imports, will be in addition to the existing PLI schemes that are already underway.

- The Policy recognizes the need for intensive research and development in the medical sector and thus aims to establish 'Centers of Excellence' in academic and research institutions, promote innovation, support start-ups, encourage private investments, venture capital funding, and public-private partnerships in this segment.

- The Policy intends to create and fill employment opportunities by skilling, reskilling, and upskilling professionals in the medical device sector through the Ministry of Skill Development and Entrepreneurship, Government of India through multidisciplinary courses in institutions for ensuring the availability of skilled manpower and producing future-ready med-tech human resources.

- To ease and promote manufacturing of medical devices in India, the Policy aims to simplify the regulatory framework by streamlining the regulatory approval process for medical devices by introducing a single-window clearance system for the import, manufacture, and sale of medical devices by providing incentives such as tax exemptions, subsidies, and funding support. This will help reduce the dependency on imports.

- To promote domestic investments, the Policy is expected to introduce a dedicated export promotion council for the medical devices sector to improve brand positioning and awareness, promoting studies and projects to learn the best global practices of manufacturing and adopt globally successful models in India.

- The Policy has also outlined the various sources of possible investment such as seed capital, funding from venture capitalists (VCs), government initiatives/ policies, public procurement through a blend of finance from public and private funds.

MCA | Companies (Compromises, Arrangements, and Amalgamations) Amendment Rules, 2023

The Ministry of Corporate Affairs (MCA) recently issued a notification on May 15, 202313 regarding the Companies (Compromises, Arrangements, and Amalgamations) Amendment Rules, 2023 (Amended Rules), which will be effective from June 15, 2023. These Amended Rules have been introduced to modify and enhance the Companies (Compromises, Arrangements, and Amalgamations) Rules, 2016, with the aim of streamlining the process of schemes related to mergers or amalgamations under Section 233 of the Companies Act, 2013, and ensuring quicker approvals for such schemes.

Key aspects:

- Time-bound process for objections/suggestions: The Amended Rules specifically amended the sub-Rules (5) and (6) of Rule 25 in the previous Rules of 2016. Previously, there was no specific time mentioned for receiving objections/suggestions from the Registrar, Official Liquidator, or any person affected by the scheme. The Amended Rules address this by introducing a time-bound process.

- 30-day period for objections/suggestions: Rule 25 (5) of the Amended Rules provides a 30-day period for receiving objections/suggestions from the Registrar, Official Liquidator, or any person affected by the scheme. After the expiration of this period, the Central Government may issue a confirmation order for the scheme within 15 days using Form No. CAA 1214.

- Deemed approval: Rule 25(5) also states that in case Central Government fails to issue an approval within 60 days of receiving the scheme, it will be considered a 'deemed approval,' and the confirmation order shall be issued accordingly.

- Actions by the Central Government: Rule 25(6)

of the Amended Rules empowers the Central Government to take

specific actions upon receiving objections/suggestions within the

30-day period mentioned in sub-Rule (5) of Rule 25 of the Amended

Rules. These actions include:

- Issuing a confirmation order within 30 days after the expiry of the 30-day objection/suggestion period if the objections/suggestions are found to be unsustainable and the scheme is in the interest of the public/creditors.

- Filing an application before the Tribunal within 60 days from the receipt of the scheme, in Form No. CAA 1315, if the Central Government, based on the objections/suggestions or otherwise, believes that the scheme is not in the interest of the public/creditors. The application requests the Tribunal to reconsider the scheme under Section 232 of the Companies Act, 2013.

These new rules introduced by the Central Government are a commendable initiative aimed at streamlining the approval process and facilitating smoother and quicker procedures for companies seeking to initiate fast-track mergers or amalgamations. These amendments will undoubtedly contribute to creating a more efficient and business-friendly environment for corporate restructuring activities in India.

SEBI | Consultation paper on delisting of non-convertible debt securities

On May 12, 2023, the Securities & Exchange Board of India (SEBI) published a consultation paper discussing the delisting of non-convertible debt securities (NCDs) seeking comments and suggestions from the public on the proposed changes in the SEBI (Issue and Listing of Non-Convertible Security) Regulations, 2021 (NCS Regulations) and the SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 (LODR Regulations).

Delisting means permanent removal of securities of an entity from the trading platform of a stock exchange, either voluntarily or compulsorily; no trading is permitted in securities which have been once delisted from a stock exchange. There may be several reasons for delisting of NCDs. Some of the major reasons are as follows:

- Very few holders of a particular class of NCDs desiring to hold such security until its maturity.

- Delisting in pursuance of restructuring debt.

- In pursuance of capital restructuring as a part of a scheme of merger or amalgamation between two entities.

Key aspects:

- Existing framework:

- Currently, the NCS Regulations and the LODR Regulations do not contain a provision for delisting of NCDs. Considering the lacuna of a prescribed legal procedure concerning the delisting of NCDs, SEBI has published the consultation paper seeking inputs from the public to build a mechanism for such delisting.

- Regulation 64 (2) of the LODR Regulations provides that in case the NCDs or the non-convertible redeemable preference shares of a listed entity do not remain listed on the stock exchange, the listed entity shall need to comply with provisions of Chapter IV of the LODR Regulations.

- Chapter IV of the LODR Regulations provides that the listed entity which has its specified securities and NCDs listed on the stock exchange is under an obligation to provide a prior intimation to the stock exchange about the meeting of its board of directors where the proposal for voluntary delisting by the listed entity is being considered. The Regulations currently do not provide a mechanism. The NCS Regulations too only prescribe issuance and listing of NCDs and are silent on the aspect of delisting of NCDs.

- Regulation 59 of the LODR Regulations lays down that a listed entity cannot make any material modification to a NCDs without prior approval of the stock exchange. Such permission shall be sought only after a resolution in this regard has been duly passed by the board of directors and the approval of the debenture trustee is obtained in the case of non-convertible debentures, and after receiving approval/ consent of the majority of holders of the class of securities sought to be materially modified in compliance with the Companies Act, 2013.

- Global Position on delisting: The perusal of

rule books of top stock exchanges including Euronext, KRX Stock

Exchange, Luxembourg Stock Exchange and the Bahrain Bourse reveals

the mechanism for delisting of NCDs is aligned at the global level

as follows:

- Globally, stock exchanges are the bodies clothed with the power to decide upon admission, suspension, withdrawal and delisting of securities in absence of other laws, rules and regulations.

- The reasons for delisting securities have been identified as

follows:

- Redemption of securities before final maturity

- If securities are listed for trading on some other platform

- Conversion of debt securities into other kind of securities due to exercise of conversion rights

- Non-compliance by the issuer with statutory rules, regulations, etc.

- If the issuer fails to include material information necessary for investor protection or provides false particulars in the issue documents for such securities

- Restructuring of debt/ capital on account of merger or amalgamation, or under a scheme of compromise

- Subsequent developments with the issuer or the security which leads to such delisting

- Liquidation or dissolution of the listed entity

- Proposed procedure: SEBI has invited comments

on the following procedure it has decided for delisting of the

securities:

- The listed entity shall file an application with the stock exchange seeking for an in-principle approval for delisting of NCDs within fifteen days of passing of the special resolution regarding such delisting as well as obtaining of other statutory approvals.

- The in-principle approval shall be given after the stock

exchange has satisfied itself that:

- Necessary approval from the board of directors has been obtained

- The debenture trustee has issued a no objection certificate

- All investor grievances have been duly resolved

- All listing fees, and fines and penalties have been duly paid upon the securities proposed to be delisted

- Interest of other stakeholders have been addressed

- The listed entity shall obtain approval of all holders of the class of NCDs proposed to be delisted within three days of the in-principle approval of the stock exchange. This shall be done through a notice which shall be sent to all shareholders. The notice shall also be published upon the website of the company.

- The approval of the holders of the class of NCDs proposed to be delisted shall be communicated to the stock exchange within five working days.

Click here to continue reading . . .

Footnotes

1. Signed Minutes - 35th GST Council Meeting.pdf

2. Signed Minutes - 37th GST Council Meeting.pdf

3. Notification70-2019- Central Tax, dated 13th Dec. 2019

4. Notification 61-2020-Central Tax, dated 30th July 2020

5. Notification 73-2020-Central Tax, dated 1st Oct. 2020

6. Notification 83-2020-Central Tax, dated 10th Nov. 2020

7. Notification 05-2021-Central Tax, dated 8th March 2021

8. Notification 01-2022-Central Tax, dated 24th Feb. 2022

9. Notification 17-22-Central Tax, dated 1st Aug. 2022

10. GSTN Advisory dated April 13, 2023

11. GSTN Advisory dated May 06, 2023

12. Notification 10/23-Central Tax, dated 10th May 2023

13. Companies (Compromises, Arrangements and Amalgamations) Amendment Rules, 2023 available at https://www.mca.gov.in/bin/dms/getdocument?mds=1Wyd8lldgilFPq8Dx6A3QA%253D%253D&type=open

14. Form No. CAA 12, pursuant to section 233 and rule 25(5), available at http://ca2013.com/wp-content/uploads/2016/12/CAA.12.pdf

15. Form No. CAA 13, pursuant to rule 25(6), available at http://ca2013.com/wp-content/uploads/2016/12/CAA.13.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.